44+ is mortgage insurance required on fha loans

Updated FHA Loan Requirements for 2023. Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans.

Greenwashing How Does Greenwashing Work With Examples

Web FHA mortgage insurance requirements Borrowers on FHA loans are usually required to pay mortgage insurance premiums MIP to the FHA.

. Web On FHA loans mortgage insurance is referred to as a mortgage insurance premium MIP. Web The plan will cut mortgage insurance costs by 30 for buyers who take out Federal Housing Administration-backed mortgage loans from 085 to 055. If you make a down payment of 10 or more youll pay.

Web In some cases you can even buy a home with a credit score of 500 but you would need to have a 10 down payment. Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans. This means if you borrow 250000 to finance a home with an FHA loan your upfront.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Ad Tired of Renting. When obtaining any government-backed financing products such as FHA 203 k rehab.

For loans with FHA case numbers assigned before June 3 2013. There is both an upfront MIP and an annual. Need an FHA loan.

With a Low Down Payment Option You Could Buy Your Own Home. Check Your Official Eligibility. Upfront UFMIP and Annual.

Since the down payment on FHA loans can be as little as 35 of the total price the government. With Rocket Mortgage the minimum credit. Web Private mortgage insurance or PMI is required by conventional mortgage loans when the loan makes up more than 80 of the purchase price.

Essentially MIP is an insurance policy required by the government on an FHA loan. If you make a down payment of less than 10 youll pay mortgage insurance for the life of the loan. If your LTV was 90 or less the borrower will pay mortgage insurance for the mortgage term or 11 years whichever occurs first.

Web An FHA mortgage insurance premium MIP is an additional fee you pay to protect the lenders financial interests in case you default on your FHA loan. Web The mortgage insurance premium MIP on FHA loans will be reduced by 030 percentage points from 085 to 055 of the loan amount. Web Borrowers will have to pay mortgage insurance for the entire loan term if the LTV is greater than 90 at the time the loan was originated.

Web Yes FHA 203 k loans require mortgage insurance. Web The upfront mortgage insurance premium is equal to 175 of the base loan amount. With a Low Down Payment Option You Could Buy Your Own Home.

Why Rent When You Could Own. Web Like FHA loans that require MIPs borrowers have to pay for private mortgage insurance PMI when using a conventional home loan with a down payment. MIP is required on all FHA loans and comes with both an upfront premium and an annual premium.

Web Mortgage lenders typically require FHA borrowers to have a homeowners policy in place prior to closing. Web An FHA Loan is a type of mortgage that is insured by the Federal Housing Administration. Credit Scores as Low as 620 with Only 35 Down Payment.

MIP is a required fee. FHA insurance provides mortgage lenders with protection which allows those lenders. Web FHA mortgage borrowers will pay 175 of their loan amount in upfront mortgage insurance costs and they typically also pay an 085 annual premium which.

Web FHA insurance protects mortgage lenders allowing them to offer loans with low interest rates easier credit requirements and low down payments starting at just 35. Credit Scores as Low as 620 with Only 35 Down Payment. It costs the same no matter your credit score with only a slight increase in price for down payments less than.

Web What is MIP. According to the Esurance website. Web FHA mortgage insurance is required for all FHA loans.

In most cases youll be asked to. The Federal Housing Administration FHA the government agency insuring this loan requires all borrowers to pay two types of mortgage insurance premiums MIPs. This is usually the case if the.

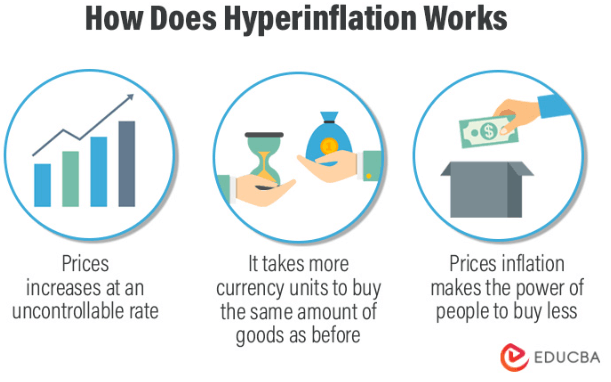

Hyperinflation Examples Features Causes Effects

Fha Requirements Mortgage Insurance For 2023

Introduction To Stock Market How Did The Stock Market Work And Invest

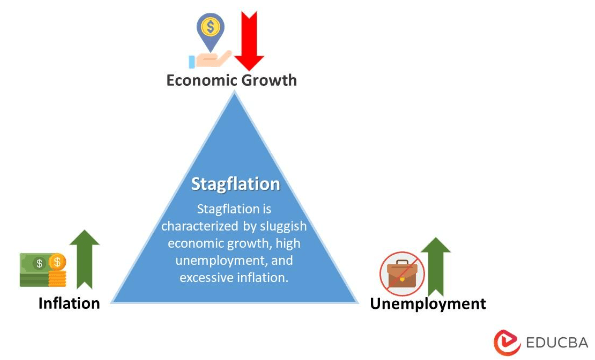

Stagflation Meaning Real World Examples Causes

Fha Mortgage Insurance Guidelines Required On Fha Loans

Fha Mortgage Insurance What You Need To Know Nerdwallet

Agency Problem Types And Reasons Behind Agency Problem

Fha Mortgage Insurance What You Need To Know Nerdwallet

Loan Note Complete Guide On Loan Note With Working And Example

Enterprise Value Explanation Example With Excel Template

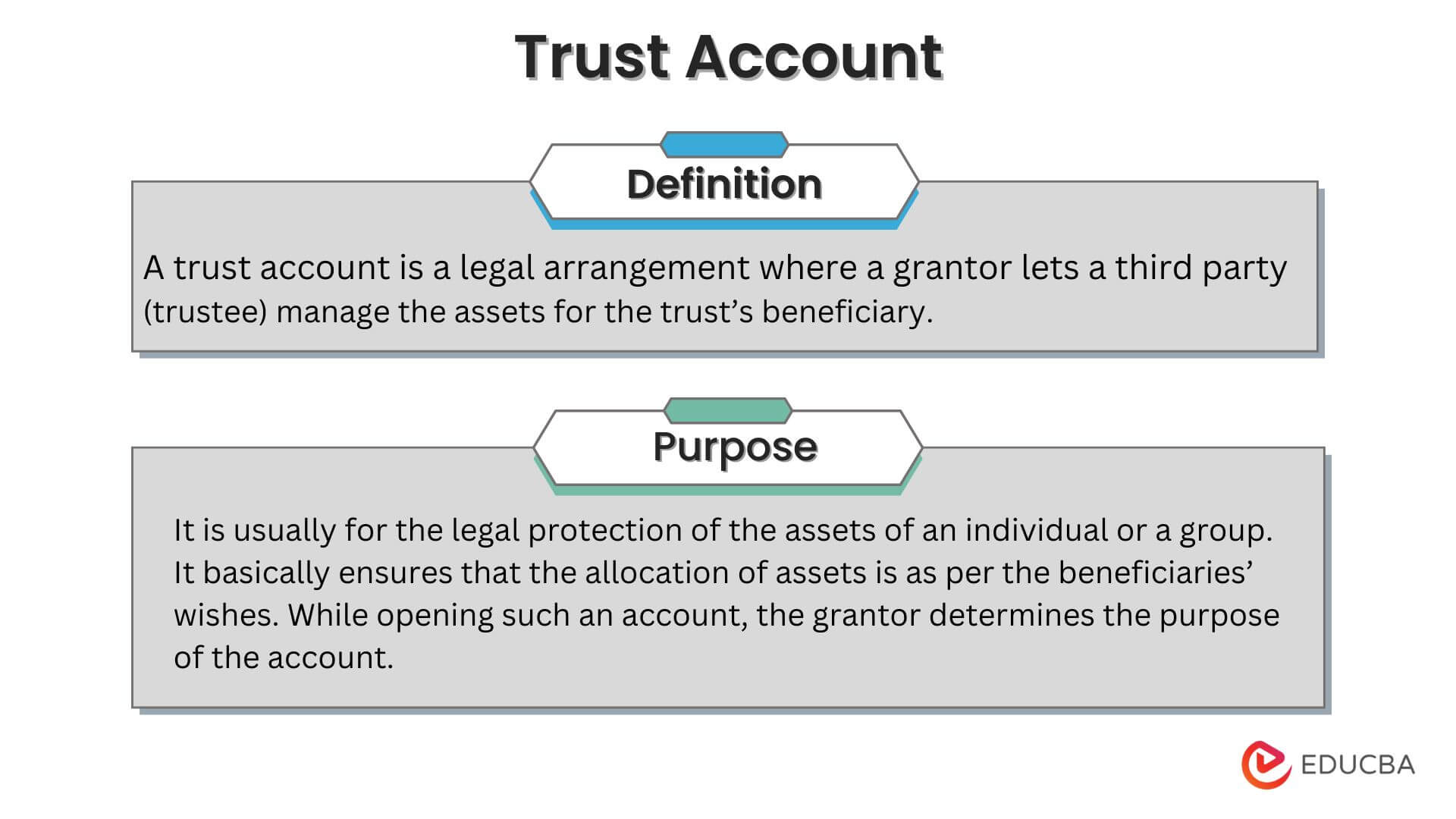

Trust Account Definition Purpose Types Rules To Set Up

Kiting A Complete Guide On Kiting With Its Working And Examples

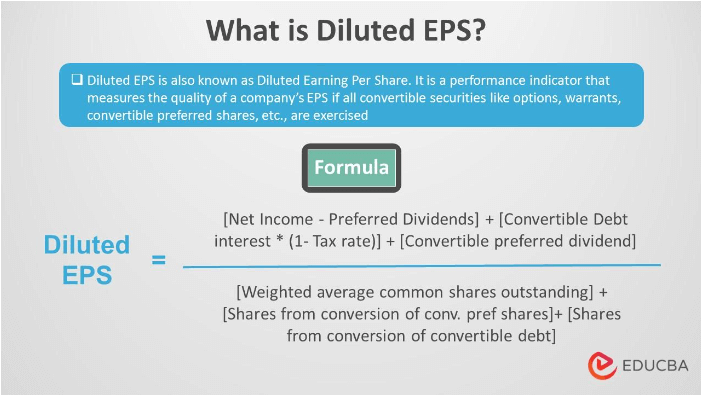

Diluted Eps Earnings Per Share Meaning Formula Examples

:max_bytes(150000):strip_icc()/how-much-do-we-need-as-a-down-payment-to-buy-a-home-1798252_FINAL-d436ccb9c27f4ced9c60c70eb01a4fdb.png)

Fha Mortgage Insurance What You Need To Know

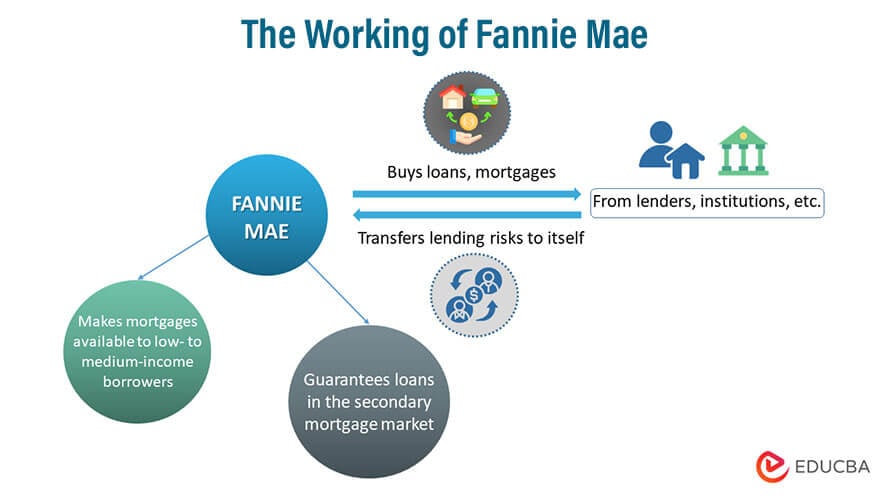

What Is Fannie Mae Purpose Eligibility Limits Programs

Fha Mortgage Insurance Guide Bankrate

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor